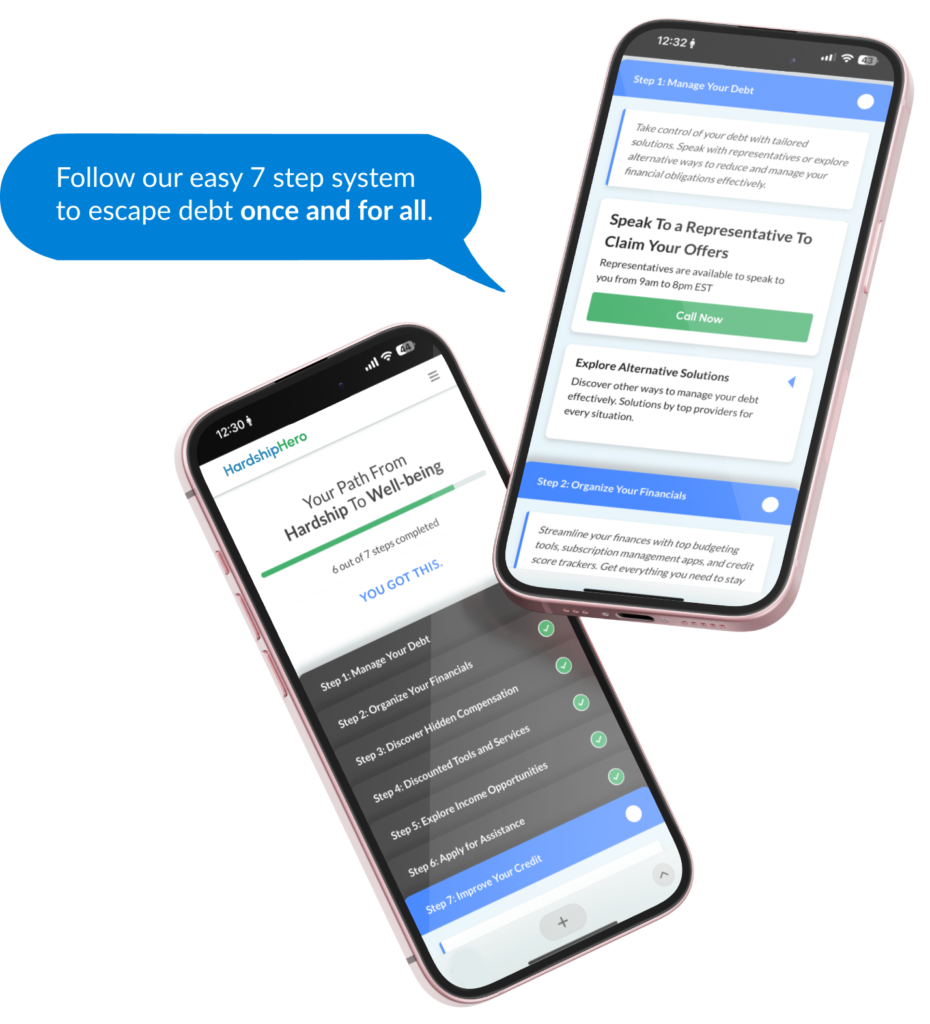

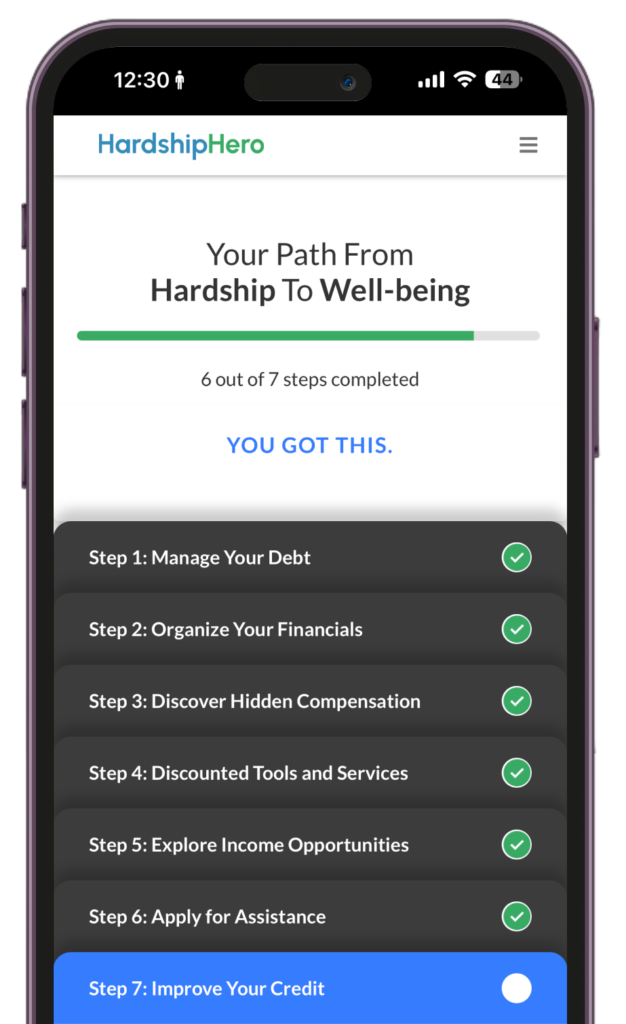

Be the hero of your own financial story

With HardshipHero as your sidekick, defeating debt isn't just possible — it's inevitable.

Whether it's consolidating debt, settling for less than you owe, or eliminating debt entirely, we'll help you activate your hidden superpowers to escape debt lightning fast.