Are you managing multiple debt payments with varying interest rates? A consolidation loan can make your financial life easier by combining all your debts into one simple payment, often at a lower interest rate. This helps you stay organized, reduce stress, and pay off your debt more efficiently

A consolidation loan is designed to give you the flexibility and control you need to get ahead of your debt, all while making payments more manageable.

Ready to find out if a consolidation loan could be the right fit for your situation? Complete our simple application today, and we’ll help match you with the best solution for your financial needs.

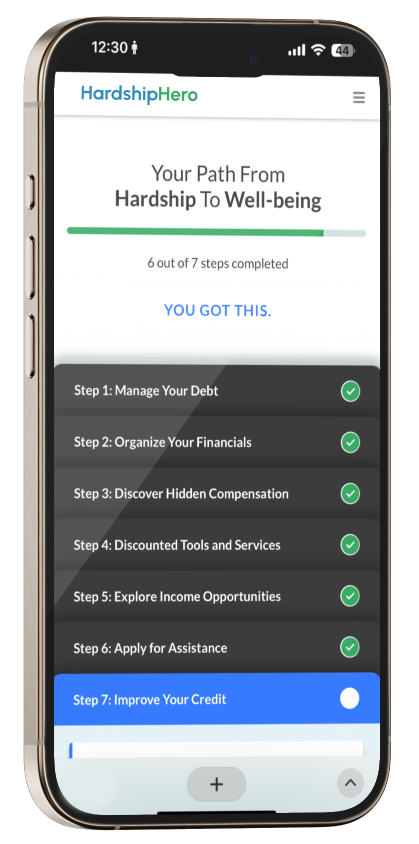

When you complete the application, you’ll also receive FREE access to the beta version of our financial app, designed to help you escape debt and regain financial control.

DISCLAIMER: At HardshipHero, LLC (“HardshipHero,” “we,” “us,” or “our”), we are committed to providing a transparent and compliant platform. The following disclaimer outlines our services, limitations, and important disclosures. By using this website, you agree to these terms.

NON-LENDER STATUS AND AFFILIATE RELATIONSHIPS: HardshipHero, LLC is not a lender, loan broker, or credit decision-maker. We do not provide cash advances, offer loans, or directly engage in lending activities. This website is not an offer or solicitation to lend. Our services function as a lead generation platform that connects individuals seeking financial assistance with third-party service providers, including lenders and financial institutions. We may receive compensation from these third-party partners for referring potential customers or forwarding user information.

LENDERS: The third-party lenders we work with are solely responsible for their loan offerings, decisions, and transactions, including compliance with federal, state, and local regulations. HardshipHero has no control over, nor responsibility for, the actions, disclosures, or agreements provided by these third-party lenders. Your engagement with a lender is subject to their specific terms and conditions.

TRIBAL LENDERS: You may be matched with a tribal lender governed by tribal and certain federal laws, which are immune from state laws, including usury caps. Tribal lenders may offer loan terms that differ from state-regulated lenders, often with higher interest rates and fees. In the event of disputes, tribal lenders may require resolution within a tribal jurisdiction. Please carefully review their terms and conditions before proceeding.

LEAD AGGREGATORS: Your information may be sent to an aggregator, not directly to a lender, and may be sold multiple times, resulting in offers from multiple lenders or marketers. Lenders may supplement your information with data from other sources to assess your eligibility for services. HardshipHero does not guarantee that all lenders can provide the specific loan type, rate, or terms you are seeking.

HOW WE MAKE MONEY: HardshipHero earns revenue through affiliate marketing and lead generation by connecting users with third-party financial service providers. When you interact with our partners’ services through our platform, we may receive a referral fee or commission. This does not affect the cost of services provided to you, nor does it impact the financial recommendations we make based on your circumstances. Our partners include debt settlement companies, loan providers, legal service firms, and others.

LOAN TERMS AND RATES: Consolidation loan options offered by our affiliates typically range from $1,000 to $50,000, with Annual Percentage Rates (APRs) between 6.99% and 35.99%. Origination fees can range from 0% to 10%, with loan terms from 12 to 60 months. As an example, a typical personal loan might involve:

Loan amount: $23,760

Origination fee: 4.95% ($1,176)

Interest rate: 18.00%

Repayment term: 48 months

Monthly payment: $697.95

APR: 20.89%

The borrower would receive $22,584 after the origination fee deduction, with a total interest of $9,741.60 and total loan cost (interest plus origination fee) of $10,917.72. Total payments made would equal $33,501.60. Only the most creditworthy borrowers receive the highest loan amounts at the lowest rates.

CASH TRANSFER TIMES: Times vary depending on lender practices and applicable local laws. In some cases, additional documentation such as faxing may be required. Credit checks may be performed to assess your creditworthiness.

THIRD-PARTY RELATIONSHIPS AND NO GUARANTEE OF RESULTS: While we strive to connect users with financial services that match their needs, HardshipHero makes no guarantee regarding the availability of loan offers, financial outcomes, or terms provided by third-party lenders. The financial solutions presented are based on individual circumstances and lender discretion. We cannot ensure that you will qualify for any specific loan, rate, or terms. Short-term loans are a costly form of credit and should be used responsibly.

STATE-SPECIFIC RESTRICTIONS: Residents of Connecticut, New Hampshire, Washington, and Vermont are not eligible to request cash advances or participate in certain loan services offered through this website. Additionally, this service may not be available in all states, and availability may change without notice.

LEGAL DISCLOSURES AND CONSUMER PROTECTION: Online Lenders Alliance (OLA): HardshipHero adheres to the OLA’s best practices and code of conduct, committing to the highest standards of customer service, compliance with federal laws, and protecting consumers from fraud. We encourage users to understand the full terms and implications of any loan or financial service before engaging with a third-party provider.

NON-DISCRIMINATION: HardshipHero does not discriminate based on race, color, religion, sex, marital status, national origin, ancestry, or any other protected characteristic. All individuals are treated equally in their interactions with our platform and our third-party partners.

LIMITATION OF LIABILITY: TO THE MAXIMUM EXTENT PERMITTED BY LAW, HardshipHero, LLC, ITS PARENTS, SUBSIDIARIES, AFFILIATES, DIRECTORS, OFFICERS, EMPLOYEES, AND AGENTS SHALL NOT BE LIABLE FOR ANY INDIRECT, CONSEQUENTIAL, INCIDENTAL, SPECIAL, PUNITIVE, OR EXEMPLARY DAMAGES ARISING OUT OF OR IN CONNECTION WITH YOUR USE OF THIS WEBSITE OR THE SERVICES PROVIDED THROUGH IT. THIS INCLUDES BUT IS NOT LIMITED TO DAMAGES RESULTING FROM YOUR USE OF LOAN SERVICES, FINANCIAL PRODUCTS, OR THIRD-PARTY PROVIDER AGREEMENTS.

HardshipHero MAKES NO WARRANTIES, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. WE DO NOT GUARANTEE THAT THIS WEBSITE WILL BE ERROR-FREE OR UNINTERRUPTED, NOR DO WE WARRANT THE ACCURACY OF ANY CONTENT OR INFORMATION PROVIDED.

PRIVACY AND DATA USAGE: Please refer to our Privacy Policy for detailed information on how we collect, use, and protect your personal data. By using this website, you agree to the terms of our data collection practices and understand that your information may be shared with third-party providers for the purpose of facilitating financial services.

UPDATES TO THIS DISCLAIMER: We reserve the right to modify this disclaimer at any time. Any changes will be reflected by updating the “Last Updated” date at the top of this disclaimer. Your continued use of this website following such changes constitutes your acceptance of the updated disclaimer.

Our app is currently in beta as a web version, and for a limited time, we’re offering FREE access to all users who complete an application. Take advantage of this exclusive offer to start managing your debt and financial goals today!

Submit your application now to unlock your free access.